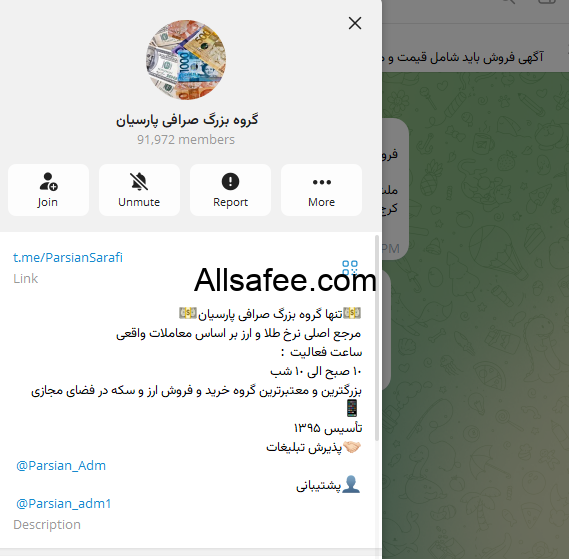

The rise of the US dollar price in Iran is not driven only by sanctions, foreign policy, or currency shortages. A significant part of this increase comes from unhealthy behaviors in the informal market—especially inside Telegram and messaging groups used for currency trading, where distorted rules have quietly reshaped pricing dynamics.

A Strange Rule That Broke Market Balance

In many of these groups, there is an explicit or implicit rule:

- ✅ Sellers must post their price

- ❌ Buyers are not allowed to post a buying price

At first glance, this rule looks like a way to prevent spam or manipulation. In reality, it does exactly the opposite.

How Banning Buy Prices Pushes the Dollar Higher

1. Destruction of Supply–Demand Balance

In any healthy market, prices are formed where supply meets demand.

When buyers are silenced:

- Only the seller’s numbers are visible

- Real demand stays hidden

- Prices rise in a one-sided and artificial way

2. Giving Power to Middlemen and Price-Makers

When only sellers can announce prices:

- Dealers use multiple accounts to post higher offers

- Market perception is pushed upward step by step

- Uncontrolled and excessive selling activity appears

This is where organized profiteers take control of the market narrative.

3. Creating Artificial Fear and Panic

Seeing a stream of high sell prices sends a clear psychological message:

“The dollar is going up—buy now or miss out.”

In reality:

- No real buyer may exist at those prices

- But since buyers cannot post offers, the truth never surfaces

4. Lack of Transparency Leads to Price Fabrication

When buy prices are forbidden:

- No one knows the price of the last real transaction

- The market drifts away from actual trades

- Prices turn into psychological signals rather than economic facts

The Consequences

- Artificial inflation of the dollar price

- Emotional and panic-driven selling

- Loss of public trust

- Harm to real consumers

- Massive profits for intermediaries, not the market itself

Practical and Real Solutions

1. Allow Both Buy and Sell Prices

A healthy market means:

- Buyers state their price

- Sellers state their price

- The deal happens at a natural equilibrium

2. Publish Completed Trades, Not Just Ads

Instead of focusing on sale announcements:

- Share confirmed transaction prices

- Not promotional or speculative numbers

3. Control Multi-Account Price Manipulation

If group admins truly want market stability:

- Limit newly created or suspicious accounts

- Stop chained and coordinated price inflation

4. Educate Users Instead of Silencing Them

Silencing buyers does not calm the market.

It makes the market blind—and dangerous.

Final Conclusion

The increase in the dollar price does not always come from top-down economic pressure.

Sometimes, it ignites inside these so-called trading groups themselves.

When:

- Selling is loud

- Buying is silent

- Transparency disappears

The result is clear: a more expensive dollar, a more distorted market, and guaranteed profits for manipulators.

The currency market needs balance, transparency, and the real voices of both buyers and sellers—not one-sided rules that fuel price inflation.